Earlier this year, during an interview on CNBC, Warren Buffett commented on how he would like his wife and her trustees to invest the cash she would inherit upon his death. The advice made waves because it was shockingly simple:

“What I advise here is essentially identical to certain instructions I’ve laid out in my will. One bequest provides that cash will be delivered to a trustee for my wife’s benefit. . . . My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors . . .”

Buffett goes on in the interview to explain his rationale:

“I laid out what I thought the average person who is not an expert on stocks should do. And my widow will not be an expert on stocks. And I wanna be sure she gets a decent result. She isn’t gonna get a sensational result, you know? And since all my Berkshire shares are going to philanthropy, the question becomes what does she do with the cash that’s left to her? Part of it goes outright, part of it goes to a trustee. But I’ve told the trustee to put 90% of it in an S&P 500 index fund and 10% in short-term governments. And the reason for the 10% in short-term governments is that if there’s a terrible period in the market and she’s withdrawing 3% or 4% a year you take it out of that instead of selling stocks at the wrong time. She’ll do fine with that. And anybody will do fine with that. It’s low-cost, it’s in a bunch of wonderful businesses, and it takes care of itself.”

“It’s low-cost, it’s in a bunch of wonderful businesses, and it takes care of itself.”

– Warren Buffet

Buffett is recommending a very simplified passive investment approach to his wife. The irony of course is that Buffett is arguably one of the best stock pickers of all time. In addition he’s also quite good at identifying and selecting skilled stock pickers. Yet despite this he’s recommending a simple (maybe too simple) passive portfolio. The reason of course, and he’s very up front about it, is that “you’re not him”. You’re not an expert in stocks, you’re not an expert in investing in stocks and you’re not an expert at identifying skilled stock pickers. If you were – well you’d be him – but you’re not.

But before you start signing in to your brokerage account, you should consider that what Buffett recommends for his wife may not work as well for you. Some things to consider:

- His wife is 68 – a portfolio that invests 90% in the S&P 500 is likely too risky but then again we don’t know all the facts. Buffett assumes she’s going to draw 3% to 4% a year for living expenses but we don’t know if that’s her only source of income and most financial advisors will tell you that you need to draw a higher percentage than 4%, unless the portfolio is very large (i.e. you are Buffett’s wife).

- Even if the prescription is correct for his wife because she has plenty of other income sources, the allocation ignores some key behavioral traps that would likely trip up many investors. Unless you have ice running through your veins, I’m guessing you’re going to have a hard time not reacting on the morning you realize you’re portfolio is now nearly halved.

- It’s also highly unlikely that a 10% cash cushion is going to suffice for a long enough period of time until your portfolio recovers from a severe drawdown scenario. Try 50% cash cushion.

Regardless with what type of passive portfolio you end up with – Buffett’s central reason for recommending a passive approach is your lack of stock expertise. But what if you could have your cake and eat it too? What if you could leverage the stock expertise of some of the most established investors in the world including Buffett and still invest passively? What if you could also build in a downside hedge into your portfolio to manage what could be severe drawdowns thus increasing the likelihood that your cash cushion could actually provide the cushion you need. What if you could wrap that all into the same prescription (modified or not) recommended by Buffett and take advantage of the transparency, liquidity and tax efficiency afforded by exchange traded funds?

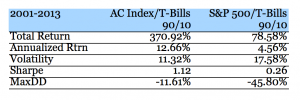

You can guess where I’m going with this. You can do exactly that. Here’s a theoretical performance comparison between Buffett’s original prescription and the same prescription but with the S&P 500 replaced by our AlphaClone Hedge Fund Long/Short Index (we assume a 1% annual fee for the index). You can thank Mr. Buffett.