This article focuses on the AlphaClone Hedge Fund Masters Index in the context of constructing the optimum portfolio. When building an optimum portfolio, the objective is to figure out the portfolio weights across different asset classes that achieve a specific optimization goal.

Our analysis constructs four different portfolios, each optimized for a different outcome:

Maximize Sharpe Ratio

The first optimization is to simply maximize the portfolio’s Sharpe ratio. In short, this is the portfolio that gives you the biggest return at the lowest risk. For you nerds, this is the optimal risk adjusted portfolio that lies on the efficient frontier.

Maximize Returns @ 8% Volatility Target

Optimizations that seek to solve for a specific volatility target first usually mean that the investor has certain recurring obligations they must satisfy from the proceeds of their portfolio. The goal is control risk first, then try to maximize returns without exceeding the client’s “risk budget”.

Minimize Volatility @ a 10% Return Target

Investors who seek a specific return target first and then seek to minimize volatility are usually long term buy and hold investors. As an example, an investor who has fallen behind on his or her retirement objectives may need to increase their target rate of return going forward but wants to make sure they are not taking on any extra unnecessary risk. They seek their return target but at the lowest possible risk.

Risk Parity

Risk parity is another risk first approach to portfolio optimization. By equally distributing the portfolio’s risk across the asset classes that make up the portfolio, the investor seeks to ensure they are not overexposed to any one class. Risk parity investors are primarily concerned about concentration risk in their exposures.

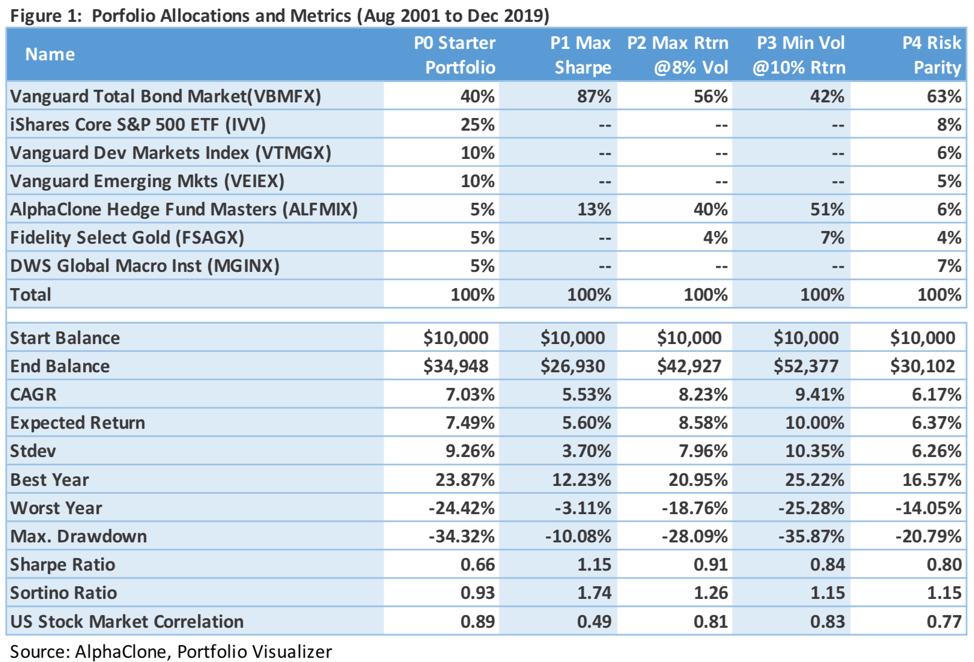

We compare each optimized portfolio with a “Starting Portfolio” that allocates to the funds/indexes below, each selected to represent an asset class:

- Bonds: Vanguard Total Bond Market Index (VBMFX)

- US Stocks (Passive): iShares Core S&P 500 ETF (IVV)

- Foreign Stocks (Developed): Vanguard Developed Markets (VTMGX)

- Foreign Stocks (Emerging): Vanguard Emerging Mkts Index (VEIEX)

- US Stocks (alpha-seeking): AlphaClone Hedge Fund Masters (ALFMIX)

- Precious Metals (Gold): Fidelity Select Gold (FSAGX)

- Alternatives: DWS Global Macro (MGINX)

Methodology

- We run our optimization exercise unconstrained in terms of minimum or maximum weightings for each asset class. We recognize that this may result, depending on the optimization goal, in a portfolio with a 100% weight to a single asset class – but we think for the purposes of this exercise, that outcome helps illuminate the role of each asset class in the portfolio. It also means that the optimization, with the exception of Risk Parity, is free to discard one or more asset classes (including ALFMIX).

- We selected the specific funds above to maximize the analysis period which is from Aug 2001 to Dec 2019 (constrained by the inception month for ALFMIX).

- We select the global macro hedge fund style for the alternatives sleeve because most investors (at least these days) allocate to alternatives to reduce the portfolio’s correlation to equities. We chose the global macro style because it has the lowest correlation to equities relative to other hedge fund styles (see this MSCI article). Ironically, the asset class with the lowest correlation to equities are not alternatives (or global macro) but bonds and gold (see correlation matrix here).

Figure 1 below summarizes allocations and portfolio metrics for each optimized portfolio.

Key Findings

- Looking across the different optimized portfolios, it is obvious that investors really don’t need much more than stocks and bonds to achieve most optimization goals.

- Most investors/advisors would likely opt to use the optimizations represented by P2 (maximize returns @ 8% volatility) or P3 (minimize volatility @ 10% return target) in the figure above. Because they are unconstrained, both optimizations allocate to only 3 of the 7 asset classes available.

- With the exception of the Risk Parity (P4) portfolio, which must allocate to each of the 7 asset classes available, all of the optimizations favored ALFMIX exclusively over the S&P 500 for exposure to US equities. That’s not surprising given that ALFMIX has both a higher CAGR and risk-adjusted returns than the S&P 500 (see Figure 2).

- For all of the optimized portfolios, every 1% in volatility yields about 1% in expected returns.

Practical Implications for Portfolio Allocation

It is instructive that unconstrained portfolio optimizations would seek to use the ALFMIX index to the exclusion of any other available equity fund. While building a portfolio or even an equity sleeve from only two or three funds may not be realistic, adding ALFMIX to whatever mix of equity exposures you have clearly adds value.

So, what’s the right allocation to ALFMIX? Of course, it depends but one way to think about your equity exposure is along a passive/active continuum. Passive sources of returns have never been easier or cheaper to access but low cost, efficient active sources of returns are a lot harder to come by – that’s where ALFMIX shines. For example, a portfolio that is 50% weighted to US equities and which seeks to achieve risk parity, might allocate 20% (40% of the total 50% equity exposure) to ALFMIX and 30% to the S&P 500. On the other hand, the same portfolio for a client who has a higher “risk budget” could increase their exposure to ALFMIX until the client’s risk budget is achieved.

© 2020, All Rights Reserved. The AlphaClone logo is a service mark of AlphaClone, Inc. The information contained herein (the “information”) may not be reproduced or re-disseminated in whole or in part without the prior written permission from AlphaClone, Inc. AlphaClone, Inc. is a registered investment advisor with the SEC. Registration of an investment advisor does not imply any level of skill or training. AlphaClone’s investment products seek capital appreciation as their investment objective. There can be no assurance that the investment objective will be achieved. Past performance is not indicative of future results. Consider the investment objectives, risks, charges, expenses and instruments used to implement a strategy before investing. This communication does not constitute an offer or a solicitation to invest with AlphaClone, Inc.

The AlphaClone Hedge Fund Masters Index (ALFMIX) is an index of high conviction equity holdings derived from hedge fund public disclosures and selected by AlphaClone. ALFMIX was launched on August 25, 2017 and is calculated by Solactive. Any performance prior to that date is hypothetical. The S&P 500 Index is an index of large capitalization US equities. It is not possible to invest in an index.